A specialized approach.

Unlike traditional lenders, we fully understand the litigation practice business model. Deferred legal fees, unpredictable file durations and increasingly onerous disbursement requirements result in unique funding challenges that banks cannot address. We can.

From sole practitioners to national full-service firms, BridgePoint Financial helps our law firm clients manage the cash flow challenges common to contingency fee arrangements.

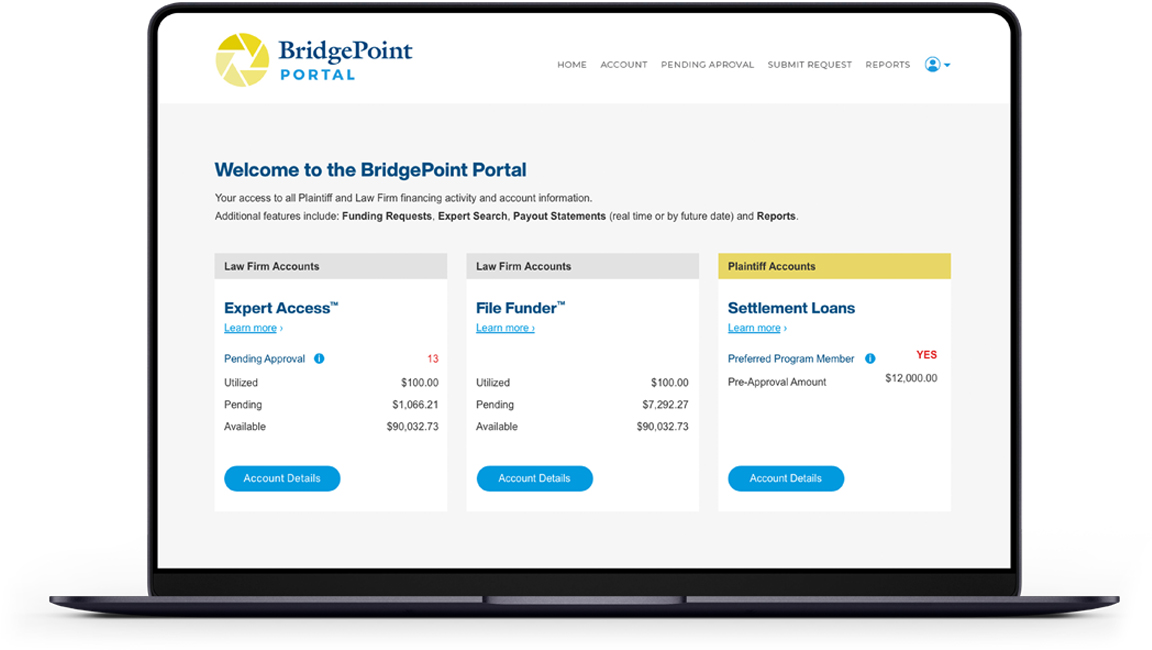

Our solutions.

We offer an array of flexible, affordable options enabling law firms to invest in their practices and optimally develop their clients’ claims.